Plan your retirement savings with ease using our interactive 401k calculator. Estimate your projected 401k balance at retirement based on your age, salary, current balance, contributions, employer contributions, retirement age, and interest rate. Start optimizing your financial future today

401K Calculator

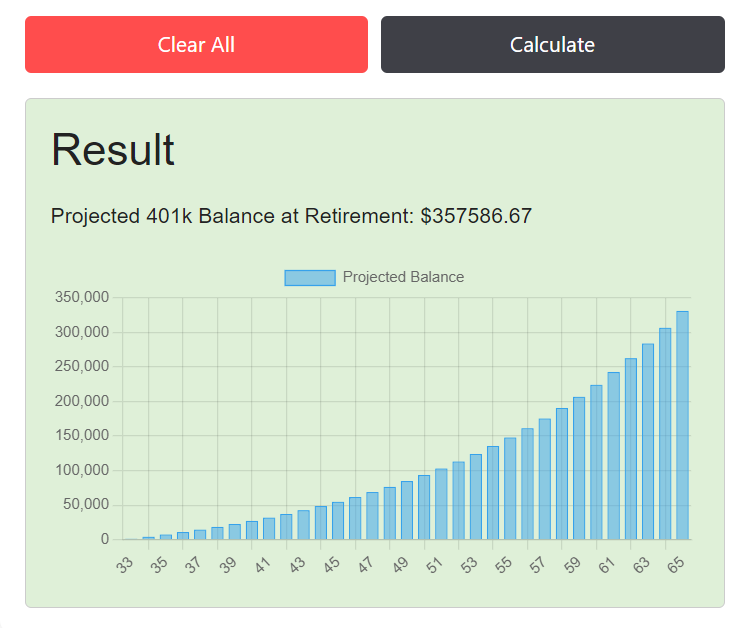

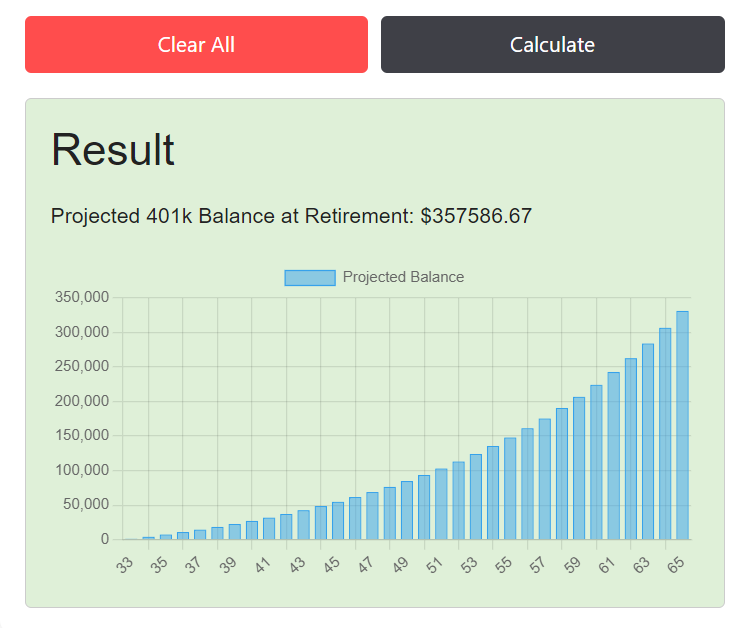

Result

Importance of 401K Calculator in Retirement Planning

Retirement planning is a important aspect of financial security, and a 401k plan is one of the most popular tools for saving for retirement in the United States. To help individuals better understand and manage their retirement savings, our 401k calculator serves as a valuable resource. In this article, we’ll delve into the significance of 401k plans, how they work, and how to utilize a 401k calculator effectively to optimize your retirement savings.

Understanding 401k Plans

A 401k plan is a retirement savings account sponsored by an employer that allows employees to contribute a portion of their pre-tax earnings to invest in a variety of funds. One of the key advantages of a 401k plan is that contributions are deducted from your paycheck before taxes are applied, which can result in significant tax savings over time.

How Does our 401k Calculator Help?

Our 401k calculator is a powerful tool that helps individuals estimate their retirement savings based on various factors such as age, salary, current 401k balance, monthly contributions, employer contributions, retirement age, and projected interest rates. By inputting these variables into the calculator, users can get a clear picture of their retirement savings trajectory and make informed decisions to maximize their savings potential.

Using the 401k Calculator

The 401k calculator provided in this article is user-friendly and intuitive. Simply input your age, annual salary, current 401k balance, monthly contribution amount, employer contribution percentage, retirement age, and expected interest rate. The calculator will then generate a projection of your 401k balance at retirement, along with a visual representation in the form of a bar chart.

Key Variables in Retirement Planning

- Age: Your current age plays a significant role in determining your retirement savings strategy. The earlier you start contributing to your 401k, the more time your investments have to grow.

- Salary: Your annual salary directly impacts the amount you can contribute to your 401k each year. Higher salaries allow for larger contributions, potentially accelerating your retirement savings.

- Current 401k Balance: This represents the amount of money already saved in your 401k account, which serves as the foundation for future growth.

- Monthly Contribution: Regular contributions to your 401k account are essential for building a substantial retirement nest egg. Even small monthly contributions can add up over time, thanks to the power of compounding.

- Employer Contribution: Many employers offer matching contributions to their employees’ 401k plans, effectively providing free money for retirement savings. Taking full advantage of employer matches can significantly boost your retirement savings.

- Retirement Age: The age at which you plan to retire influences the duration of your savings period and the amount of time your investments have to grow.

- Interest Rate: The projected rate of return on your 401k investments plays a crucial role in determining your retirement savings growth. While it’s essential to be realistic about expected returns, even modest interest rates can generate substantial wealth over time.

Benefits of Using 401k Calculator

- Accurate Projections: Our 401k calculator provides personalized projections based on your specific financial situation, offering a realistic estimate of your retirement savings potential.

- Financial Planning: Armed with accurate projections, individuals can make informed decisions about their retirement savings strategy, including adjusting contribution amounts or retirement age to meet their financial goals.

- Visual Representation: The visual representation provided by the 401k calculator allows users to easily understand their projected retirement savings trajectory, making it easier to identify areas for improvement.

Tips for Maximizing Your Retirement Savings

- Start Early: The power of compounding means that the earlier you start saving for retirement, the better. Even small contributions made early in your career can grow significantly over time.

- Take Advantage of Employer Matches: If your employer offers a matching contribution to your 401k, be sure to contribute enough to maximize this benefit. Failing to do so is essentially leaving free money on the table.

- Increase Contributions Over Time: As your income grows, consider increasing your contributions to your 401k account. Even small percentage increases can have a significant impact on your long-term savings.

- Diversify Your Investments: Diversification is key to reducing risk in your investment portfolio. Spread your contributions across a variety of funds to minimize exposure to market fluctuations.

- Regularly Review Your Plan: Life circumstances can change, so it’s essential to review your retirement savings plan regularly and make adjustments as needed. This includes updating contribution amounts, investment allocations, and retirement age as your financial situation evolves.

FAQs for the 401k Calculator

What is a 401k calculator, and how does it work?

A 401k calculator is a financial tool designed to help individuals estimate their retirement savings based on various factors such as age, salary, current 401k balance, contributions, employer matches, retirement age, and expected interest rates. Users input these variables into the calculator, which then generates a projection of their 401k balance at retirement.

Why should I use a 401k calculator?

A 401k calculator provides personalized projections tailored to your specific financial situation, allowing you to make informed decisions about your retirement savings strategy. By understanding how different variables impact your retirement savings, you can maximize your contributions and work towards a financially secure retirement.

Is the 401k calculator easy to use?

Yes, our 401k calculator is user-friendly and intuitive. Simply input your age, salary, current 401k balance, monthly contributions, employer contribution percentage, retirement age, and expected interest rate. The calculator will then generate a projection of your 401k balance at retirement, along with a visual representation for easy understanding.

What factors does the 401k calculator take into account?

The 401k calculator considers several key variables, including your age, salary, current 401k balance, monthly contributions, employer contributions, retirement age, and projected interest rates. By inputting these factors, you can get a comprehensive view of your retirement savings trajectory.

How accurate are the projections generated by the 401k calculator?

While the 401k calculator provides estimates based on the information you provide, it’s essential to remember that these projections are only estimates and may not reflect actual future performance. Factors such as market fluctuations and changes in personal circumstances can impact the accuracy of the projections.

Can I adjust the inputs in the 401k calculator?

Yes, you can adjust the inputs in the 401k calculator to reflect changes in your financial situation or retirement goals. Whether you want to increase your contributions, adjust your retirement age, or update your expected interest rate, you can easily modify the inputs to see how they affect your retirement savings projection.

What should I do with the results from the 401k calculator?

The results from the 401k calculator can serve as a valuable guide for your retirement planning. Use the projections to assess your current savings strategy, identify areas for improvement, and make adjustments as needed to work towards your retirement goals.

Is my personal information secure when using the 401k calculator?

Yes, your privacy and security are important to us. The 401k calculator does not collect or store any personal information. All calculations are performed locally on your device, ensuring that your financial data remains private and secure.

Can I use the 401k calculator for long-term financial planning?

Absolutely! The 401k calculator is a versatile tool that can help you plan for your financial future beyond retirement. Whether you’re saving for a major purchase, planning for education expenses, or setting long-term financial goals, the calculator can provide valuable insights into your savings strategy.

Where can I access the 401k calculator?

ou can access the 401k calculator directly from our website. Simply visit https://401k-calculator.org and navigate to the 401k calculator page to start planning your retirement savings journey.

401k Calculator: Plan a Secure Retirement - 401k Calculator

Plan your retirement savings with ease using our interactive 401k calculator. Estimate your projected 401k balance at retirement based on your age, salary, current balance, contributions, employer contributions, retirement age, and interest rate. Start optimizing your financial future today

Price: Free

Price Currency: $

Operating System: Browser, Android, Windows

Application Category: Financial Calculator

4.99